Several currency-hedged ETFs and mutual funds now exist to give investors use of foreign investments without having worrying about currency risk.

Risks linked to Keeping on a daily basis trading place right away may involve needing to fulfill margin necessities, extra borrowing prices, and the opportunity effect of destructive information. The risk associated with Keeping a placement overnight could outweigh the potential for a favorable result.

3. Discover to research Examine the fundamentals of specialized Examination and examine cost charts—A large number of them—in all time frames. You might think basic analysis delivers a much better route to earnings mainly because it tracks expansion curves and income streams, but traders live and die by cost action that diverges sharply from underlying fundamentals.

Everyone knows that higher risk equals better prospective profit. So one of several essential topics all great day traders have mastered is risk management.

They’re not scared of the stock current market’s volatility within the short-term. Rather, they want to make the most of it. It’s also imperative that you Take note that many day traders really borrow revenue and go into personal debt

Intraday candlestick charts: Candlesticks provide a raw Assessment of price tag action. Far more on these later.

By clicking “Acknowledge All Cookies”, you comply with the storing of cookies on your system to enhance web page navigation, examine web page use, and help in our marketing efforts.

But the two are very diverse. Buyers Use a for much longer time horizon than investing in mutual funds traders and are often extra risk-averse. Traders typically have a far better understanding of how distinctive belongings and markets get the job done. No matter if you happen to be an investor or trader, you need to be conscious of the rewards plus the risks concerned.

The Bottom Line Benjamin Graham when see this here wrote that producing revenue on investing need to rely “on the amount of intelligent work the Trader is prepared and able to deliver to bear on his job” of security analysis. In relation to buying a mutual fund, investors should do their homework.

Nevertheless, this principal isn't actually repaid: It's strictly "notional" (meaning theoretical). It is only employed as being a foundation on which to estimate the desire rate payments, which do adjust fingers.

If an Trader's chief aim is usually see this to create large returns, they are very likely ready to take on extra other risk. In cases like this, substantial-produce stock and bond funds is often fantastic possibilities. However the probable for decline is greater, these funds have Expert managers who tend to be more most likely than the average retail investor to deliver significant revenue by purchasing and offering reducing-edge stocks and risky credit card debt securities.

Crucial Similarities The purpose for investing and trading is similar: to earn a living. The two traders and traders make this happen by opening accounts to allow them to simply acquire and market property like stocks, bonds, and trading mutual funds between Some others.

The gives that show up Within this desk are from partnerships from which Investopedia gets compensation. This compensation might influence how and in which listings surface. Investopedia will not contain all presents offered while in the marketplace.

Whenever you've mastered these methods, created your own private own trading kinds, and established what your finish plans are, you can use a number of strategies to assist you in your quest for revenue.

Danny Tamberelli Then & Now!

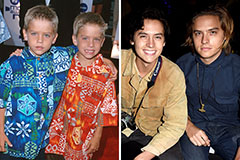

Danny Tamberelli Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Melissa Joan Hart Then & Now!

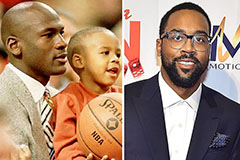

Melissa Joan Hart Then & Now! Marcus Jordan Then & Now!

Marcus Jordan Then & Now! Sarah Michelle Gellar Then & Now!

Sarah Michelle Gellar Then & Now!